Can AI Make You Rich? The Wild Rise of Automated Wealth

I keep seeing these ads on Instagram saying AI will make more millionaires in the next few years than the entire internet did in the past thirty. Normally when people are throwing around insane claims like that, it piques my interest, especially when money is involved.

There was a time when growing wealth just meant showing up.

You clocked in and hustled, climbed the corporate ladder, and enjoyed your nice benefits and employer matched 401k. You sat across desks and traded handshakes and endured long commutes and longer meetings while trading hours for dollars, and time for security, energy was the currency for the distant promise of financial freedom.

But something’s shifting.

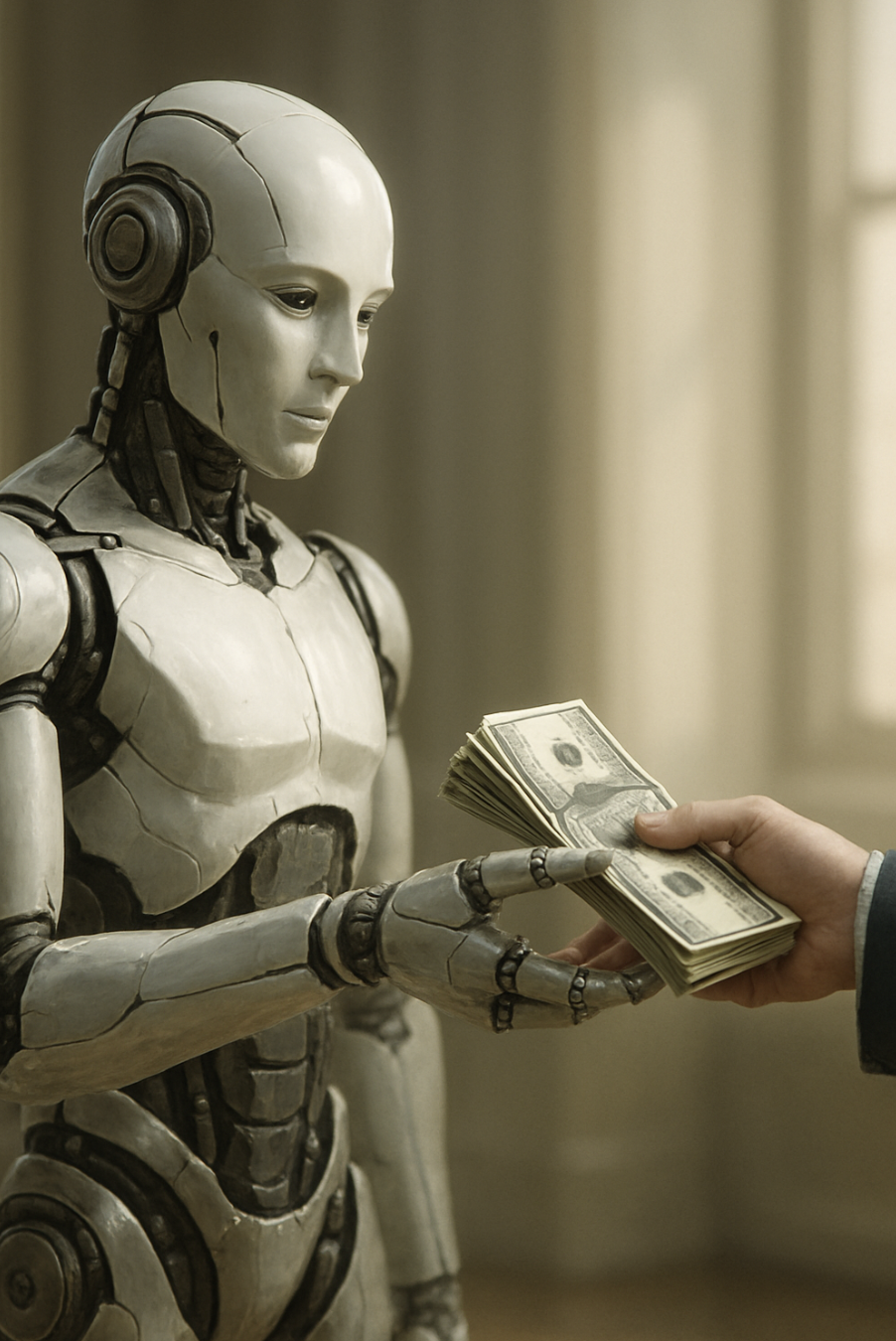

Because now, in the bloom of algorithms and silicon logic, people are starting to ask, can a machine do this for me?

Not just the work part of it, but the wealth aspect.

From crypto bots to robo-advisors to AI-generated side hustles, we’re entering a new age: the age of automated money.

But can AI really make you rich? There’s some truth to it, and a bit of psychology of turning code into cash. The future of wealth might just be synthetic.

Money That Earns While You Sleep

It’s the ultimate fantasy of mine (and I’m sure yours as well), trading bots growing your portfolio while you’re on a beach sipping Paper Planes and Nuts & Berries. Look up those cocktails if you don’t know what they are, trust me.

In my wildest dreams AI models writes my blog posts, ranks on Google, and earns affiliate income. Or maybe a custom GPT assistant manages your Shopify store and answers emails. Oh, oo, a robo-advisor rebalances your portfolio with zero input.

Eh, so this is highly theoretical at this point and while lots of people claim they’re doing this online, I really just don’t believe it.

The dream is simple and revolves around leverage. More output, less input = more profit, less presence.

But behind the glamor is a question burning a hole in my mind: how does this actually work? (and does it)

Crypto Bots: The 24/7 Traders

Cryptocurrency never sleeps…and neither do bots. AI-driven crypto bots scan the market in real-time, executing trades based on price fluctuations, technical indicators, volume patterns, and pre-set strategies (mean reversion, momentum, arbitrage).

Some popular platforms growing in popularity are 3Commas (lets you set up smart trading bots for Binance, Coinbase, and others), Cryptohopper (cloud-based bot that adjusts based on market conditions), and Bitsgap (combines multiple exchanges into one automated dashboard).

It really seems like some people have made thousands…some, millions online, but it’s also hard to tell what’s real or not these days. There could very well be a bunch of bots posting those success stories so you invest your money. It could also be employees doing that. I worked at a restaurant once where the owner had us write fake 5 star reviews to boost our rating, that shit happens in real life.

These programs are also not magic, it’s math, timing, and risk. And it’s not free to use.

For every moonshot, there’s a margin call, and these bots can amplify gains, but also accelerate losses.

Verdict: can make you rich, but only if you treat it like trading, not a slot machine.

Robo-Advisors: Set It, Forget It, Grow It

If you’re not a day trader, don’t worry, robo-advisors were made for you!

These AI-powered platforms automatically invest your money based on your risk profile, rebalance your portfolio, and even optimize for tax efficiency (harvesting losses, minimizing capital gains). How kind of them. They don’t do it out of the goodness of their hearts though, and it might cost you to get into this to begin with.

Top players in this field are Betterment, Wealthfront, SoFi Automated Investing, and Schwab Intelligent Portfolios.

They typically charge low fees (0.25% or less) and are ideal for long-term investors who want to build slow, steady wealth, without ever checking stock tickers.

Verdict: yes, they can make you rich, but over decades, not days.

AI Side Hustles: Income on Autopilot

We’re in the early stages of a wild new trend: AI-powered side hustles. And I’m sorry to come in here and burst your bubble, but here I come.

People are using tools like ChatGPT, Midjourney, and automation stacks to write eBooks and sell them on Amazon, create digital art for Etsy and Redbubble, build SaaS tools with AI-generated code (Replit gets a shout out here!), launch faceless YouTube channels with voice AI and stock footage, and start dropshipping stores run by AI customer service bots.

In short, they’re building micro-businesses that launch fast, run lean, and scale passively.

Do they work…sometimes I guess. The danger of doing things like this is that most people and programs and rushing to put AI generated filters on everything. If you can beat the clock then maybe you’ll get somewhere, but I think most of these platforms already have solid filter systems in place. More often than not though…you won’t. Google and Bing has filters to prevent AI spam from clogging up their search engines. Once your website has been flagged as spam, it will take a lot more effort to get yourself out of there.

As a self-published author I can also tell you that as soon as the first person buys your book and gives you a 1 star review, it’s over for you. You won’t sell another book.

Many of these things fizzle out, and while a few “explode” I couldn’t find any TRUE examples of success doing these things.

With low upfront cost and infinite scalability, the appeal is obvious, but maybe a little too good to be true.

Verdict: I don’t think this can make you rich. You need to put in the real time into your side hustles for them to have any value at all.

AI in Real Estate: The New Landlords

AI is now creeping into real estate investment, helping people analyze properties based on market data, automate tenant screening and communication, forecast rent trends, and run Airbnbs on autopilot with dynamic pricing bots. Honestly, this is where I think AI really thrives in life, analyzing data.

Companies like Doorvest and Arrived Homes use AI to help investors purchase, manage, and profit from rental properties with minimal effort. And with fractional investing, you don’t even need to own the whole building!

Verdict: can build wealth, but still tied to real-world assets and not fully passive.

AI for Financial Planning: Your Custom CFO

Apps like Monarch, Cleo, and Tiller use AI to track your spending, predict future cash flow, suggest savings goals, and optimize your budget based on habits.

Soon, these tools may offer real-time investment advice, suggest tax strategies, and negotiate bills on your behalf.

Think of it as having a tiny CFO in your pocket.

Verdict: won’t make you rich directly, but will help you keep and grow more of what you earn.

The Illusion of Effortless Riches

Here’s the dark side of automated wealth, you can start believing you don’t need to think anymore.

And that’s when you lose.

AI is fast, smart, and scalable, but it’s not wise. It doesn’t know your values, your risk tolerance, your dreams.

It only knows data, patterns, and predictions. You should use AI as a tool to analyze your data, but not as a way of actually doing the thing you’re trying to do.

If you blindly follow bots without understanding the why, you’ll end up broke, not free.

True wealth still requires discernment. You need to remember that as all the claims on social media go wild claiming they have the way to make you rich, quick. Ever hear the term “get rich quick scheme”? If it sounds too good to be true…it is.

The reason AI wealth is so seductive isn’t just greed. It’s exhaustion.

I, personally, am tired of working three jobs, of student loans and rent hikes, and of saving pennies while inflation eats dollars faster than I can realize what’s happening.

AI offers a new and super seductive dream,“what if I didn’t have to grind forever?”

And for some, that dream could eventually (with time and patience) pay off.

But for all its power, AI won’t replace wisdom, strategy, or emotional resilience. It’s a tool, not a savior, so use it, but don’t worship it.

If I haven’t convinced you yet and you’re really determined to try to use AI to generate money for you, then start small. Automate your budget and use ChatGPT to brainstorm business ideas that you, yourself will go off and try.

You can try a robo-advisor with a few hundred dollar and stay curious as to their process and what they do. Learn how AI works behind the scenes and understand the risks in crypto, SaaS, and automation on the front and back end.

Diversify yourself and don’t rely on a single bot or trend. Many eggs should equal many baskets. Mix passive income with active projects that keep your values first and use tech to support your life…not to escape from it.

Build systems for your life, not hacks

Wealth isn’t about windfalls, it’s about sustainability AI can help, but you’re still the architect of your life.

Yes, AI can make you rich, but the deeper truth is that wealth still comes from vision and from knowing when to speed up, and when to rest.

Let the machines handle the math, while you handle the meaning. The future of wealth isn’t just automated, it’s aligned.